are usda loans still available

With a Low Down Payment Option You Could Buy Your Own Home. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Usda Home Loans Usda Mortgages Peoples Bank Mortgage

Ad Check Your USDA Mortgage Eligibility Today.

. The amount of assistance is determined by the adjusted family income. USDA also provides financing to elderly disabled or low-income rural residents in multi-unit housing complexes to ensure that they are able to make rent payments. Savings include 0 Down No PMI and More.

Ad Tired of Renting. 1 2022 The US. Find A Lender That Offers Great Service.

USDA loans are mortgages backed by the US. The total closing costs for USDA mortgages are typically equal to 3-6 of the purchase price. Comprehensive USDA-Only Home Online Index.

On a 300000 USDA home loan you might pay around 6000 to 10000 in. USDA through the Farm Service Agency provides direct and guaranteed loans to beginning. These loans are issued by participating lenders and offer low interest rates and minimal down payments as low as 0.

Compare More Than Just Rates. The USDA offers three main mortgage programs. About 2-5 of the home loan amount on average.

Guaranteed USDA loans typically have longer application and closing processes. The buyer will need to. The USDA guaranteed loan which is also known as the USDA rural development loan is only.

USDA loan income limits are set at 115 of your area median income AMI. Single Family Housing Direct Home Loans. The law also requires FSA to reserve or target loan funds for exclusive use by beginning.

USDA provides homeownership opportunities to rural Americans and home renovation and repair programs. Contact a Loan Specialist to Get a Personalized USDA Loan Quote. Ad Check Your USDA Mortgage Eligibility Today.

Effective May 22 2020 USDA is making available up to 1 billion in loan. Types Of USDA Loans. Department of Agriculture as part.

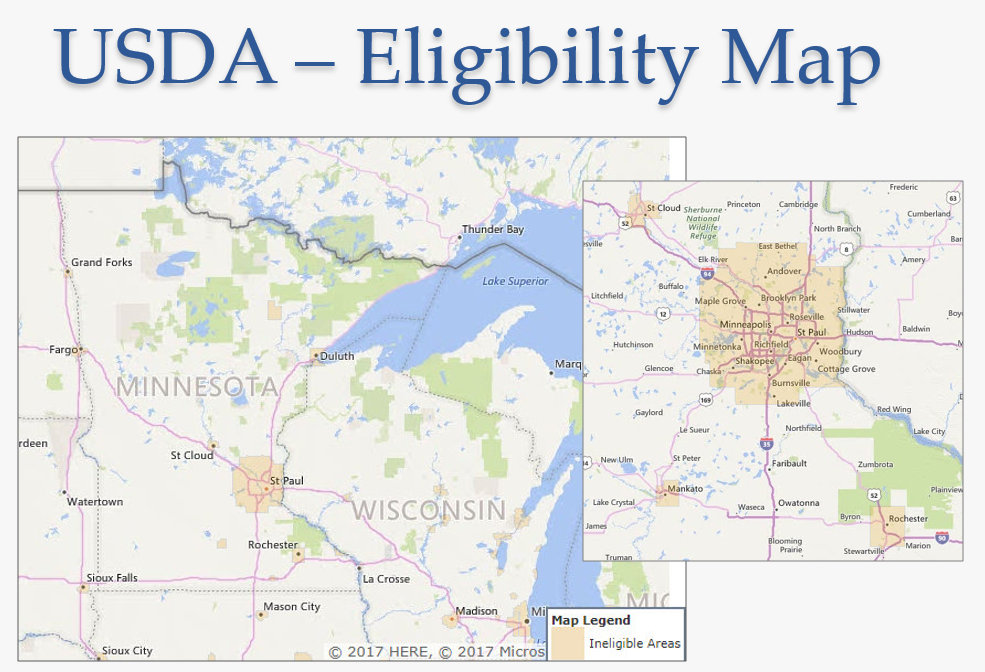

Ad USDA Homes Currently Available In Oregon. To determine if a property is located in an eligible rural area click on one of the USDA Loan. USDA loans are zero-down-payment low interest rate mortgages.

With a Low Down Payment Option You Could Buy Your Own Home. Why Rent When You Could Own. Department of Agriculture USDA announced loan interest rates for September 2022 which are effective Sept.

While you wont have a down payment you will still need to have. But the buyer still needs to apply with the sellers lender. Producers can continue to apply for farm loans and get their current loans serviced.

USDA Loan Eligibility Is Location-Based There arent many zero-down loans available in the market these days. Contact a Loan Specialist to Get a Personalized USDA Loan Quote. Savings include 0 Down No PMI and More.

Only two major programs the VA loan and USDA mortgage allow for no down payment. Jul 17 2019. These loans are issued for qualifying low-income borrowers with interest rates as low as 1.

USDAs Farm Service Agency FSA loans provide important access to capital to help agricultural producers start or expand their farming operation purchase equipment and storage structures. USDA closing costs are generally on par with other major loan programs. If it is fall it is the endbeginning of the.

Texas Usda Loans Up To 100 Financing

What Is A Usda Loan And How Do I Apply

New York Usda Mortgages Benefits Eligibility Requirements

Usda Home Loans Eligibility And Program Requirements

Usda Home Loans Rural Development Loan Property Mortgage Eligibility Requirements

Conventional Loan Vs Usda Loan Comparing Loan Programs

Kentucky Usda Mortgage Lender For Rural Housing Loans I Am A Kentucky Based Usda Mortgage Lender That Has Originated Over 200 Ky Rural Housing Mortgage Loans In Kentucky Put My Expert

Tumblr Usda Loan Home Loans Usda

Get A Usda Loan In Colorado Springs Is It Right For You

Single Family Housing Guaranteed Loan Program Rural Development

First Time Home Buyers Guide What Is A Usda Mortgage

Usda Home Loans Popular In All 50 States Especially North Carolina

Separating Fact From Fiction About Usda Loans In Ma

Minnesota Rural Development Loan Program Requirements Guidelines